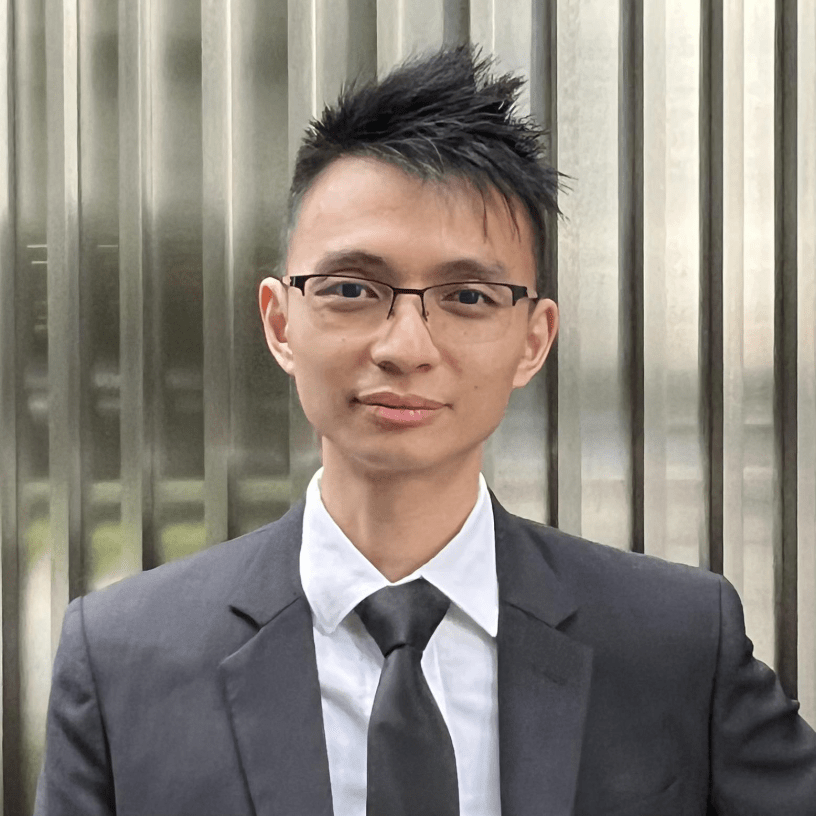

Meet Mu Ming, who isn’t your typical finance guru. Once an ordinary professional in Singapore, he lost over $300,000 in failed investments, scams, and “too-good-to-be-true” schemes. But instead of giving up, he used the experience to build a systematic, low-risk option selling strategy that now helps others achieve financial independence.

Today, Mu Ming is a sought-after option selling coach and creator of the 100k2FIRE framework, a proven system that empowers busy professionals to generate consistent cash flow in as little as 15 minutes a week. What makes Mu Ming’s journey stand out is not just the recovery from financial loss but his clarity of vision. His philosophy? “Cash Flow + Mastery = True Freedom.”

What first inspired you to create the 100k2FIRE framework and how did your personal loss of $300,000 shape your philosophy towards cash flow and financial freedom?

The 100k2FIRE philosophy didn’t happen overnight. It evolved over three years of daily reflection and consistent posting—starting with sales, then diving into personality, willpower, habits, and eventually investing.

I once explored a “100k to retire” framework, but realised I didn’t want to retire—I wanted financial independence. That pivot led to what 100k2FIRE is today.

The $300k loss shaped much of this journey. $100k vanished in investments—half was my wife’s. Our first potluck investment failed during our first year of marriage. That hit hard.

Another $50k went to courses and seminars, plus poor decisions. The next $50k was lost in questionable schemes, even with so-called professionals. Then came a $98.8k loss during my early option selling days. I’m now net positive, but those losses were my tuition fees.

From all this, I distilled a core formula: Cash Flow + Mastery = True Freedom. You need consistent cash flow first—then, pursue mastery. Without it, we have nothing of value to offer. That’s the core of 100k2FIRE.

You made a bold move resigning from your corporate job to pursue this lifestyle business. What was going through your mind during that transition and how do you find clarity amid uncertainty?

I wouldn’t call it a bold move. It was a calculated risk, mixed with frustration and some past experience. It wasn’t my first attempt to break out.

In the past, I’d tried being a full-time investor, trader, solopreneur, and freelancer, but always with the mindset of making it work by the next month. The problem is that we need time to build skill sets such as mastery, as I mentioned earlier.

By the time I resigned in September 2024, I already had some direction. From June to September 2024, I had been generating about SGD 4k a month, and my living expenses were low—about $1.8k—even before my late mum passed away. Knowing I was backed by numbers gave me courage.

As for the frustration, I was hired to innovate in my last role but found the hierarchical structure too rigid. I couldn’t make meaningful changes. So, this “bold move” was really a mix of numbers, tension, and prior learnings.

How do you explain this concept of “Cash Flow + Mastery = True Freedom” to someone who is still trapped in the traditional 9 to 5 mindset?

There are two perspectives. I don’t try to convince anyone that the 9 to 5 is wrong. I just explain. Most of us start from a job, and I think it’s a good thing to have a consistent structure that brings in regular cash flow.

That income can then support us as we experiment, make mistakes, and gradually become good at something.

A job won’t last forever. Eventually, we need to own something in our own name. That’s why I think the formula makes sense. Secure your cash flow first, then build your mastery. That’s how we buy time, gain confidence, and eventually create true freedom.

Beyond teaching option selling, you talk about buying time—to grieve, to heal, to build. Why do you believe time, not just money, is the real measure of wealth?

Wealth means different things to different people. I come from a modest background. So for me, wealth means not being stressed about basic needs like food.

This idea is also rooted in my childhood. I grew up among older cousins and often felt I couldn’t contribute. I was the youngest, so I thought my opinions didn’t matter and felt stupid for even trying. That insecurity followed me through school and into adulthood.

Today, wealth means having enough money to build a skill or mastery I’m proud of, so that I feel good about my work and, by extension, myself. My dad passed seven years ago. Back then, I was a freelance trainer with no savings. I couldn’t even grieve properly. I had to keep working.

More recently, my mum passed away a month ago. This time around, I had the financial space to slow down, process, and heal. That’s real wealth to me, having time and space when it matters most.

I was stuck in one for years. I was constantly learning, never doing. It likely stemmed from low self-esteem. I didn’t feel I could contribute, especially after an aunt told me I was “picked from the garbage.” That stuck with me.

What advice would you give your younger self?

Honestly, I wouldn’t bother. My younger self was too stubborn to listen. But for someone open-minded, here are three key lessons:

First, start doing, then learn along the way. I spent my 20s attending wealth seminars and analysing speakers instead of taking real action. Understanding sales tactics didn’t translate into results.

Second, beware the learning loop. I was stuck in one for years. I was constantly learning, never doing. It likely stemmed from low self-esteem. I didn’t feel I could contribute, especially after an aunt told me I was “picked from the garbage.” That stuck with me.

Lastly, understand accountability and counterparty risk. I lost $100k because I didn’t slow down to assess intentions. Even licensed professionals face KPI pressure. So ask yourself: are they serving you, or their targets?

Option selling is often misunderstood or seen as risky. How do you help people build the discipline, structure, and self-control needed to manage risk sustainably?

Anything can be risky if you don’t know what you’re doing. Basketball is risky for me—if you pass me the ball, I’ll probably get hit in the face before I realise what’s happening.

Back when I first heard about options, it sounded like a scam. I didn’t bother learning. Three years later, someone brought it up again, and I gave it a shot. I learned the basics and eventually progressed to more advanced strategies. Once you understand the fundamentals, it gets easier.

Option selling is actually safer than traditional investing or trading because we can manage our psychology better. Traders want short-term gains, investors want long-term results. Option selling, if structured correctly, gives us the best of both worlds.

In my teaching, I make things systematic. Weekly actions are structured to be sound across all market conditions. When you have structure, you develop discipline and with that, risk becomes manageable.

What’s your vision for Singapore in the next five years?

I’ve been thinking about this and frankly, I’m concerned. AI is replacing both low- and high-level jobs, especially those that are routine and repeatable. Some say, “AI won’t replace you; someone using AI will,” but either way, jobs are disappearing.

Another belief is that “people buy emotions,” so staying human matters. But look at Gary Vee’s prediction: people might one day marry virtual influencers. If that becomes normal, where are we headed?

So what does Singapore offer to global MNCs? We have no natural resources but just our people. But if AI displaces most of the workforce, then what’s left?

The answer: cash flow plus mastery. First, build financial literacy such as know what to buy, what to avoid, who to trust. Then learn to trade or invest for cash flow. Once stable, focus on mastering a skill so valuable that people want to work with you.

If we scale this, we stay relevant. If not, we risk being left behind.

If you could have a superpower for one day, what would it be and why?

If I could grant one superpower, I’d give people courage, cash flow, and conviction. Courage to start something. Cash flow to sustain it for more than two weeks.

And conviction to keep going until they get so good they can commit to it for life. That’s what most people are missing—not talent, but the right runway and belief to persist.

Connect with Mu Ming: Facebook.